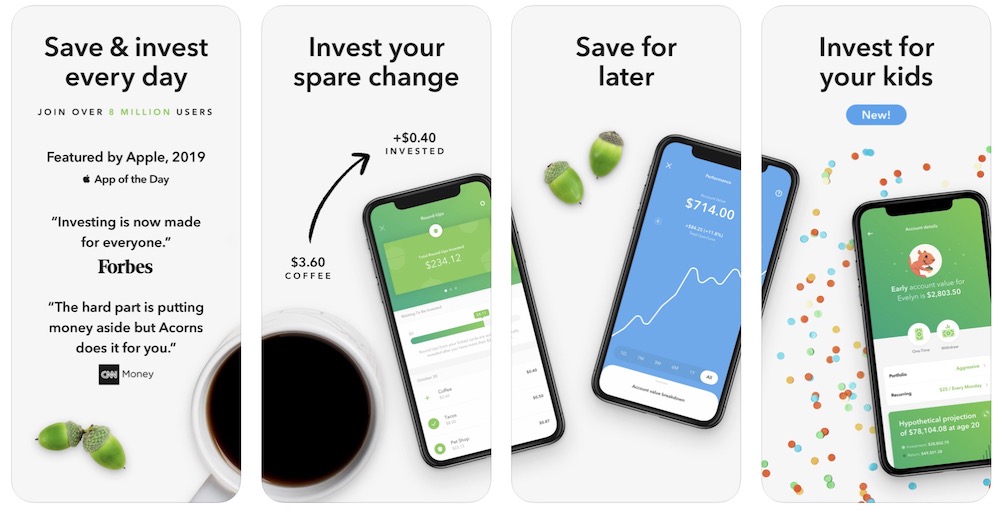

You can make automatic transfers or simply move money into the account on special occasions. Set up the account however you would like. This account allows you to invest on behalf of your children through a UTMA or UGMA account. Many families wonder how they can give their children a head start. Card holders can access over 55,000 ATMs at no additional cost. Out of all the investment apps we’ve reviewed, the Acorns Spend debit card comes with one of the largest fee-free ATM networks in the United States. The account is linked to a Visa debit card, which can also be used for investment round-ups if you’d like. Looking to combine your investing and banking needs with a single company? Acorns can help! Acorns Spend is a checking account that you can also set up. While no investments are guaranteed, a more conservative portfolio means that funds are more likely to be available when you need them. Depending on your preference, your retirement account can be funded through round-ups or you can set up automatic transfers.Īs you get closer to retirement, Acorns will rebalance your portfolio so that it is a bit more conservative. You can use Acorns Later to set up a Roth, traditional, or SEP IRA. Acorns LaterĪcorns Later is an account your future self will thank you for. Your money is invested in a portfolio made up of a combination of stocks and bonds in ETFs that match your investing profile, risk tolerance, and goals. So what makes it micro? It specializes in taking small amounts of money (like round-ups from credit card purchases) and allowing you to invest. It functions like a typical taxable investing account. Acorns InvestĪcorns Invest is a micro-investing account. Let’s explore some of the different ways Acorns can help you grow your money. What stood out most to us in this Acorns app review is that there’s sure to be an Acorns investments option that is right for you. Worried that you won’t know where to invest? When you open your account, Acorns will work with you to determine a best-fit portfolio based on your income, risk tolerance, and goals. You can also make recurring contributions to supercharge your investment accounts. Once your spare change adds up to $5, Acorns will start to invest your money in a diversified ETF portfolio featuring over 7,000 stocks and bonds.

Acorns offers three different low-cost tiers of service, depending on the types of Acorns investments you need.Acorns is a robo-advisor that creates an expert portfolio based on your unique needs or allows you to customize your options.Acorns popularized micro-investing with their round-up feature.Acorns is one of the best investment apps for beginners.As an added benefit, Acorns can also help you start investing on behalf of your children.

Of course, you can also set up recurring contributions.Īcorns allows you to invest in a variety of ways, including traditional taxable investment accounts and retirement accounts, such as Roth IRAs. Once that spare change totals $5, that money is invested into your account.

You can set up the round-up feature, which means that Acorns will collect spare change from purchases that you make using linked cards. This tool is especially powerful because there are multiple ways that it keeps your investments working behind the scenes. While the app excels as the best investment app for beginners, Acorns can work for investors at any level. *This post may contain affiliate links, please see my disclosureĪcorns is a micro-investing app designed to help people grow their financial dreams.

0 kommentar(er)

0 kommentar(er)